New Income Banded Council Tax Reduction Scheme for Working Age

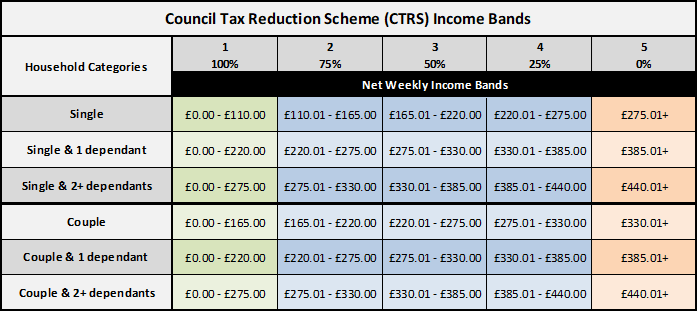

The Council Tax Reduction Scheme (CTRS) for Working Age customers is an income-banded system based on household make-up and weekly net income, which will give you a percentage reduction on your council tax liability, if you meet the criteria. If you are eligible for CTRS, you could see a discount on your council tax liability between 25% and 100%, after any discounts or exemptions have been applied to your council tax account, depending on how your household fits the criteria.

The aim of the new scheme is to make the amount of support customers receive more stable month-to-month. The scheme also offers those on the lowest incomes up to 100% discount on their council tax bill.

From the 1st April 2024 we have introduced a banded scheme for working aged customers. If you have less than £8,000 capital, then you can apply.

How does the scheme work?

The scheme works by placing your weekly net income into a band.

If your income changes, either above or below the amounts for the income band (see table above), you have been awarded, you must report your change within 21 days.

If your income changes and you remain in the same band, the amount of support you get towards your Council Tax bill won't change. The amount of support you receive towards your Council Tax bill will only change if your income changes and this moves you into another income band.

This should make it easier for customers to budget as they will know what support they will get from month-to-month.

To see how much Council Tax Reduction you may be entitled to and the amount of Council Tax you may be liable to pay after any discounts or exemptions and Council Tax Reduction have been applied, please our Council Tax Reduction Scheme tables for 2025 to 2026.

If you are of pensionable age, the government has set rules that are used to calculate the amount of council tax reduction you will get.

What does this mean for customers?

If you claim council tax support, when you receive your new bill it will tell you what support you are receiving, based on your income and household make-up.

When we calculate your income to work out your band, we will not take into consideration the following:

- Carers Allowance

- Child Benefit

- Disability Living Allowance

- Employment and Support Allowance support components

- Personal Independence Payments (PIP)

- Universal Credit Carer Element

- Universal Credit Disabled Child Element

- Universal Credit Housing Element

- Universal Credit Limited Capacity to Work Element

- Universal Credit Limited Capacity to Work Restricted Access Element

In addition, residents:

- Who are in work, an earnings disregard of £50 per week for couples or lone parents and £25 per week for single people.

- Who claim a disability benefit will receive a £60 disregard from their income.

- In the lowest income band will be eligible for 100% discount on their bill, after any applicable discounts or exemptions have been applied.

- Can ask for their claim to be backdated for 12 months.

We will also no longer issue a separate award letter, as your bill will show you how much Council Tax Reduction you have received. However, your bill will not display the income band or % of your award.

What if the support I have received has gone down?

If your council tax support reduces because of the new scheme and you are facing exceptional financial hardship as a result, please contact us as soon as possible.

Check if you're eligible and apply for council tax reduction

You can claim 'council tax reduction' if you receive a council tax bill for the property you live in, and the bill is in your name or joint names with someone else.

Council Tax Discounts and Exemptions

If you think you may be eligible to apply for a Council Tax Discount or Exemption, apply online now.